Lack of Interest in Australian Bitcoin ETFs Blamed on Bad Launch Timing, Strong Inflows Globally

Bitcoin (BTC)-backed exchange-traded funds (ETFs) of various types are now widely available to investors around the world. But the popularity of the funds varies, with investors in Australia showing almost no interest in trading the recently-launched ETFs there.

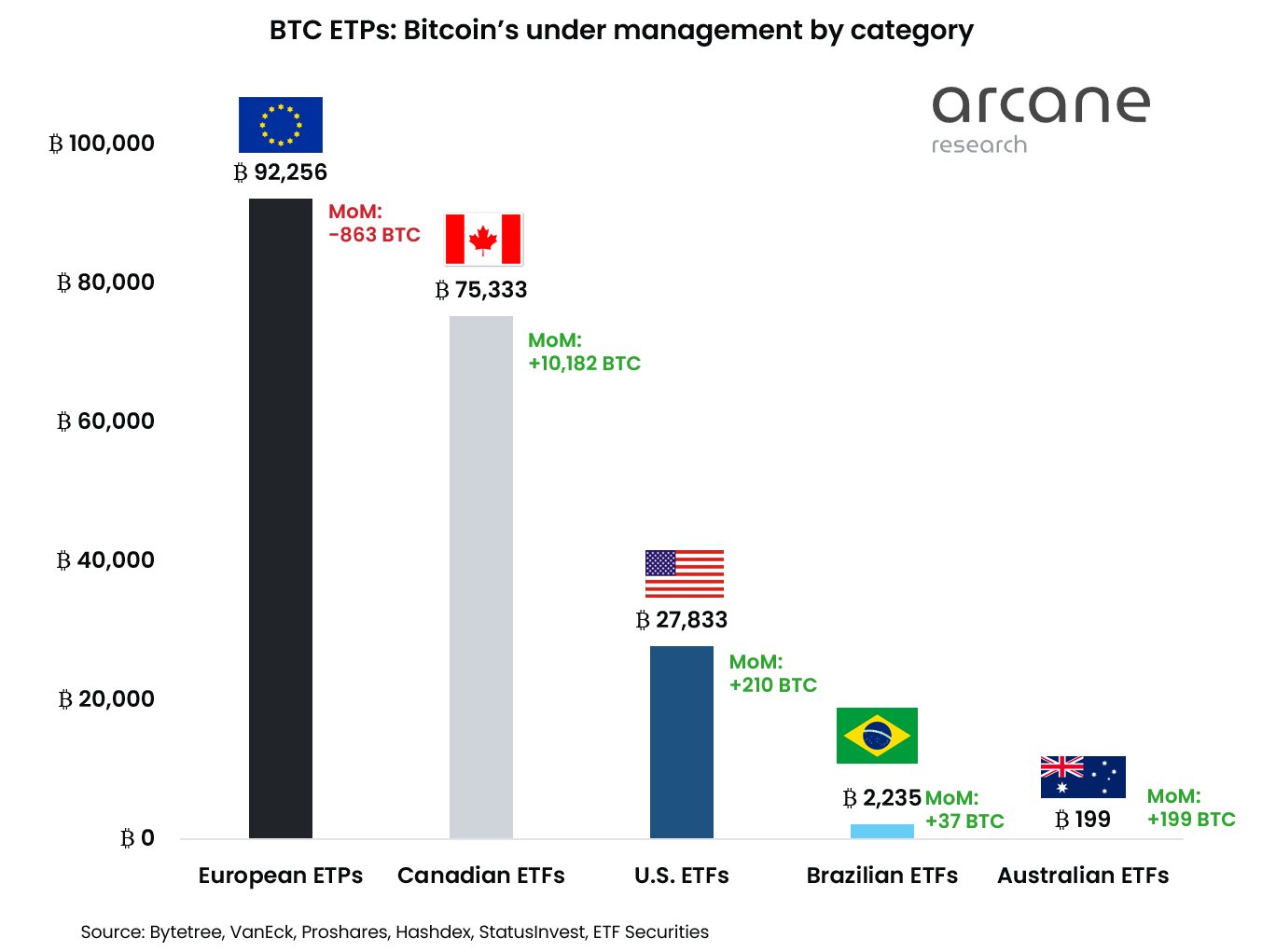

Australia is the region that stands out the most for its lack of interest in bitcoin ETFs, where the first such ETFs launched as recently as April this year. Since then until June 2, ETFs in the country have only amassed BTC 199 (USD 5.96m), data from crypto researcher Arcane Research shows, as shared by their analyst Vetle Lunde.

The weak interest in this region stands in sharp contrast to Europe, where local ETPs (exchange-traded products) have BTC 92,256 (USD 2.76bn) under management, the highest number of all regions.

Meanwhile, Europe was followed by Canada as the region with the second-highest number of bitcoin under management, with BTC 75,333 (USD 2.25bn) held by Canadian ETFs as of June 3, the data showed.

According to Arcane Research analyst Vetle Lunde, the muted interest in bitcoin ETFs among Australian investors can be partly explained by the fact that the first ETFs there launched around the same time as the collapse of LUNA and the Terra ecosystem happened.

“[T]hese ETFs launched at the worst time possible,” Lunde told Cryptonews.com, explaining that the launch happened at “the peak of the wide de-risking across all equities” and on top of the crypto market meltdown that was ignited by the collapse of LUNA and terraUSD (UST).

He added that flows into Australian bitcoin ETFs are likely to strengthen over time, and opined that the ETF known as EBTC issued by ETFS Management stands to benefit the most due to its direct exposure to bitcoin.

Still no US spot ETF

An important thing to note when looking at the data is that, unlike in Europe and Canada, there is still no bitcoin spot-based ETF approved in the US. Instead, investors in the US domestic market are left with bitcoin futures-backed ETFs, which invariably ends up costing the investor more.

According to Arcane’s Lunde, Canadian ETFs – and especially the US dollar-hedged versions – are likely to see outflows once a spot-based ETF is approved for the US market. European ETFs, however, are more insulated from this risk, according to Lunde, who said they will “likely not experience any major outflows.”

And although many hopeful bitcoin investors have waited patiently for years already, Arcane’s analyst said that things are happening which make it likely that such an ETF will soon get approved in the US.

“[O]dds are in favor of an ETF approval some time in 2023,” Lunde said.

Among the positive factors that could make a difference is the new crypto bill from two US senators, as well as a rule change filing by crypto exchange FTX that would allow it to clear trades directly without going through middlemen.

Strong inflows globally

Notably, the lack of interest among Australians came despite the fact that the inflows into bitcoin ETFs globally have increased in recent months.

From having BTC 188,091 under management in April to BTC 197,86 in May, the amount of bitcoin under management by ETFs globally had already reached BTC 205,008 three days into the month of June, marking an increase of BTC 7,152 in just three days.

The news of the strong inflows was shared by Lunde on Twitter, and quickly picked up by leading voices in the crypto community:

The inflows serve as proof that investors have not given up on the number one cryptocurrency despite heavy losses over the past two months, and are instead taking advantage of the lower prices to accumulate more coins.

From a price of more than USD 45,000 on April 1, BTC was down by about 33% to USD 30,000 as of Friday at 08:30 UTC. Over the past week, the price was down by 1.4% at the same time.

____