Cyprus SEC Extends FTX Europe’s License Suspension Until September 2024

Last updated: | 2 min read

Following FTX’s collapse, the Cyprus Securities and Exchange Commission (CySEC) extended the suspension of FTX Europe’s license until September 2024.

CySEC Directive Requires FTX Europe to Fulfill Obligations Amidst Legal Challenges

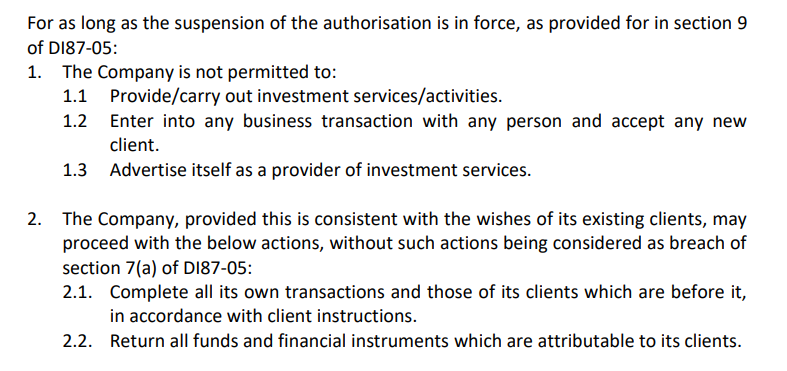

As per the CySEC directive, the extended suspension prohibits FTX Europe from offering investment services, entering new business transactions, advertising its services, or accepting new clients until September 2024.

This directive compels FTX Europe to focus on fulfilling its existing obligations amidst ongoing legal challenges.

Notably, CySEC has directed the firm to complete all outstanding obligations to its clients, including finalizing transactions and returning funds and financial instruments.

This development comes amidst a series of legal and financial challenges faced by FTX Europe and its leadership. Formerly known as Digital Assets AG, the firm was embroiled in controversy following its acquisition by FTX Group, led by Sam Bankman-Fried.

Allegations of financial impropriety and improper use of funds have further complicated the firm’s legal proceedings, with court filings seeking the recovery of millions of dollars from its leadership.

These legal battles coincide with developments within FTX’s leadership structure, further complicating the situation for FTX Europe. The sentencing of former FTX CEO to a 25-year prison term on charges of fraud and money laundering casts a shadow over the exchange’s tumultuous history.

Against this backdrop, FTX Europe’s journey from its inception to its current state reflects the volatile nature of the cryptocurrency industry and the complexities of corporate restructuring.

FTX Legal Battles and Financial Disputes

FTX’s bankruptcy proceedings have been fraught with legal disputes and financial complexities. Lawyers representing FTX creditors have sought to recover considerable amounts from the leadership of FTX Europe, alleging misappropriation of funds and improper business practices.

Court documents reveal accusations of excessive bonus payments and earn-out arrangements totalling hundreds of millions of dollars in connection with FTX Europe’s acquisition of other entities.

Despite ongoing legal battles, FTX has made strides in recovering assets and addressing its financial obligations to creditors and customers. The exchange has reportedly recovered billions of dollars in liquid assets, though extensive liabilities remain outstanding.

Under a proposed settlement, FTX Europe co-founders Patrick Gruhn and Robin Matzke would buy back the unit’s assets for $32.7 million https://t.co/3IjTX4BG4Z

— WSJ Pro Bankruptcy (@WSJBankruptcy) February 23, 2024

Also, following FTX’s collapse and protracted bankruptcy disputes, the subsidiary was sold back to its founders, Patrick Gruhn and Robin Matzke. Matzke also asserts that FTX Europe’s expansion was derailed by the exchange’s international failure and damaged reputation.

Despite the setbacks, the settlement reached between FTX and its former subsidiary reflects a commitment to resolving legal disputes and mitigating the impact on stakeholders, including clients and investors.

However, with the extended suspension from CySEC and ongoing legal challenges, the future of FTX Europe remains in a state of flux.